UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

(Amendment (Amendment No. )_____)

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | ||

Definitive Proxy Statement | ||

☐ | ||

Definitive Additional Materials | ||

☐ | ||

Soliciting Material Pursuant to §240.14a-12 |

Interface, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Interface, Inc. |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | ||||

No fee required. | ||||

☐ | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1) | Title of each class of securities to which transaction applies: ______________________________________________________ | |||

(2) | Aggregate number of securities to which transaction applies: ______________________________________________________ | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ______________________________________________________ | |||

(4) | Proposed maximum aggregate value of transaction: ______________________________________________________ | |||

(5) | Total fee paid: ______________________________________________________ | |||

☐ | ||||

| Fee paid previously with preliminary materials. | ||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |||

(1) | Amount previously paid: ______________________________________________________ | |||

(2) | Form, Schedule or Registration Statement No.: ______________________________________________________ | |||

(3) | Filing party: ______________________________________________________ | |||

(4) | Date Filed: ______________________________________________________ | |||

| Page | |||

| ||||

1 | ||||

| ||||

2 | ||||

2 | ||||

5 | ||||

7 | ||||

9 | ||||

18 | ||||

18 | ||||

19 | ||||

27 | ||||

27 | ||||

28 | ||||

28 | ||||

34 | ||||

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS (ITEM 3) | 35 | |||

36 | ||||

36 | ||||

37 | ||||

37 | ||||

37 | ||||

37 |

|

Interface, Inc.

2859 Paces Ferry Road, Suite 2000

Atlanta, Georgia 30339

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The annual meeting of shareholders of Interface, Inc. (the “Company”) will be held on Monday,Tuesday, May 13, 2013,17, 2016, at 3:00 p.m. Eastern Time, at the Vinings ClubOverlook III Conference Center located at 2859 Paces Ferry Road, Atlanta, Georgia. The purposes of the meeting are:

Item | Recommended Vote | |||

1. | To elect | FOR | ||

2. | To approve executive compensation, often referred to as a “say on pay”. | FOR | ||

3. | To ratify the appointment of BDO USA, LLP as independent auditors for | FOR | ||

4. | Such other matters as may properly come before the meeting and at any adjournments of the meeting. | |||

The Board of Directors set March 8, 201311, 2016 as the record date for the meeting. This means that only shareholders of record at the close of business on March 8, 201311, 2016 will be entitled to receive notice of and to vote at the meeting or any adjournments of the meeting.

The Board of Directors is using the attached Proxy Statement to solicit Proxies from shareholders. Please promptly complete and return a Proxy Card or use telephone or Internet voting at your earliest convenience. Voting your Proxy in a timely manner will assure your representation at the annual meeting. You may of course, change or withdraw your Proxy at any time prior to the voting at the meeting.

By order of the Board of Directors | ||

| ||

/s/ Raymond S. Willoch | ||

Raymond S. Willoch | ||

Secretary |

April 2, 2013

March 31, 2016

PLEASE PROMPTLY COMPLETE AND RETURN A PROXY CARD

OR USE TELEPHONE OR INTERNET VOTING PRIOR TO THE MEETING SO THAT YOUR VOTE

MAY BE RECORDED AT THE MEETING IF YOU DO NOT ATTEND PERSONALLY.

|

Interface, Inc.

2859 Paces Ferry Road, Suite 2000

Atlanta, Georgia 30339

FOR ANNUAL MEETING OF SHAREHOLDERS

The Board of Directors of Interface, Inc. (the “Company”) is furnishing this Proxy Statement to solicit Proxies for Common Stock to be voted at the annual meeting of shareholders of the Company. The meeting will be held at 3:00 p.m. Eastern Time on May 13, 2013.17, 2016. The Proxies also may be voted at any adjournments of the meeting. It is anticipated that this Proxy Statement will first be made availablesent or given to shareholders on or about April 2, 2013.6, 2016.

The record of shareholders entitled to vote at the annual meeting was taken as of the close of business on March 8, 2013.11, 2016. On that date, the Company had outstanding and entitled to vote 66,166,31065,459,106 shares of Common Stock.

Each Proxy for Common Stock (“Proxy”) that is properly completed (whether executed in writing or submitted by telephone or Internet) by a shareholder will be voted as specified by the shareholder in the Proxy. If no specification is made, the Proxy will be voted (i) for the election of the nominees listed in this Proxy Statement under the caption “Nomination and Election of Directors,” (ii) for the resolution approving executive compensation, and (iii) for the ratification of the appointment of BDO USA, LLP as independent auditors for 2013.2016. A Proxy given pursuant to this solicitation may be revoked by a shareholder who attends the meeting and gives notice of his or her election to vote in person, without compliance with any other formalities. In addition, a Proxy given pursuant to this solicitation may be revoked prior to the meeting by delivering to the Secretary of the Company either an instrument revoking it or a duly executed Proxy for the same shares bearing a later date.

An automated system administered by the Company’s transfer agent tabulates the votes. Abstentions and broker non-votes are included in the determination of the number of shares present and entitled to vote for the purpose of establishing a quorum. A broker non-vote occurs when a broker or other nominee who holds shares for a customer does not have authority to vote on certain non-routine matters because itswithout instructions from their customer, such customer has not provided any voting instructions on the matter. Abstentionsmatter and the broker or other nominee returns a Proxy (or otherwise informs the transfer agent) that they are not voting on the equivalent of a non-vote since (i) directors are elected by a pluralitymatter for the foregoing reasons. Neither broker non-votes nor abstentions will affect the outcome of the votes cast, and (ii) other proposals are approved ifvote on any matter expected to be voted upon at the affirmative votes cast exceed the negative votes cast. Broker non-votes are not counted for purposes of determining whether a proposal has been approved.annual meeting.

If your shares of Common Stock are held by a broker, bank or other nominee (e.g., in “street name”), you should receive instructions from your nominee, which you must follow in order to have your shares voted —– the instructions may appear on a special proxy card provided to you by your nominee (also called a “voting instruction form”). Your nominee may offer you different methods of voting, such as by telephone or Internet. If you do hold your shares in “street name” and plan on attending the annual meeting of shareholders, you should request a proxy from your broker or other nominee holding your shares in record name on your behalf in order to attend the annual meeting and vote at that time (your broker or other nominee may refer to it as a “legal” proxy).

The expense of this solicitation, including the cost of preparing and mailing this Proxy Statement, will be paid by the Company. Copies of solicitation material may be furnished to banks, brokerage houses and other custodians, nominees and fiduciaries for forwarding to the beneficial owners of shares of the Company’s Common Stock, and normal handling charges may be paid for the forwarding service. In addition to solicitations by mail, directors and employees of the Company may solicit Proxies in person or by telephone, fax or e-mail. The Company also has retained Georgeson Inc.,LLC, a proxy solicitation firm, to assist in soliciting Proxies from record and beneficial owners of shares of the Company’s Common Stock. The fee paid by the Company for such assistance willis expected to be $8,000 (plus expenses).

NOMINATIONNOMINATION AND ELECTION OF DIRECTORS

(ITEM 1)

The Bylaws of the Company provide that the Board of Directors shall consist of a maximum of 15 directors, with the exact number of directors being established by action of the Board taken from time to time. TheCommencing as of the 2016 annual meeting of shareholders, the Board of Directors has set the number of directors at 10. (The Board of Directors will consider adding, subsequent to the annual meeting of shareholders, a potential eleventh director.)9. The term of office for each director continues until the next annual meeting of shareholders and until his or her successor, if there is to be one, has been elected and has qualified.

In the event that any nominee for director withdraws or for any reason is not able to serve as a director, each Proxy that is properly executed and returned will be voted for such other person as may be designated as a substitute nominee by the Board of Directors. Each nominee (other than Mr. Gould) is an incumbent director standing for re-election, and each nominee has consented to being named herein and to serve or continue serving as a director if elected or re-elected.

Certain information relating to each nominee proposed by the Board is set forth below. Directors are required to submit an offer of resignation upon experiencing a job change.

| Name (Age) | Information | |

|

| |

| Mr. | |

Andrew B. Cogan | Mr. Cogan was elected to the Board in January 2013. Since 2001, Mr. Cogan has been the Chief Executive Officer of Knoll, Inc., a leading designer and manufacturer of branded office furniture products and textiles recognized for innovation and modern design. He previously served as Chief Operating Officer of Knoll and held several positions in Knoll’s design and marketing group worldwide, including Executive Vice President |

| ||

Carl I. Gable | Mr. Gable was elected as a director in March 1984. He practiced business, securities and international law for 26 years, most recently with the Atlanta-based law firm of Troutman Sanders LLP from 1996 until his retirement in 1998. Mr. Gable now is a private investor. His prior experience includes service as the Vice Chairman and Chief Financial Officer of Intermet Corporation, which was a publicly traded | |

Jay D. Gould (56) | Mr. Gould is a new nominee for Director. He joined the Company as Executive Vice President and Chief Operating Officer in January 2015, and was promoted to President and Chief Operating Officer in January 2016. From 2012 to January 2015, Mr. Gould was the Chief Executive Officer of American Standard Brands, a kitchen and bath products company. Prior to his employment with American Standard Brands, Mr. Gould held senior executive roles at Newell Rubbermaid Inc., a global marketer of consumer and commercial products, serving as President of its Home & Family business group from 2008 to 2012 and President of its Parenting Essentials business group from 2006 to 2008. He also previously held executive level positions at The Campbell Soup Company (2002-2006) and The Coca-Cola Company (1995-2002). Mr. Gould brings to the Board a broad range of executive level experience at international companies with distribution into both the commercial and consumer channels, with particular expertise in sales, marketing, brand management, strategy and operations. | |

Daniel T. Hendrix | Mr. Hendrix joined the Company in 1983 after having worked previously for a national accounting firm. He was promoted to Treasurer of the Company in 1984, Chief Financial Officer in 1985, Vice President-Finance in 1986, Senior Vice President-Finance in 1995, Executive Vice President in 2000, and President and Chief Executive Officer in July 2001. He was elected to the Board in October 1996, and was elected Chairman of the Board in October 2011. Mr. Hendrix served as a director of office technology solutions provider Global Imaging Systems, Inc. from 2003 to 2007, and has served as a director of American Woodmark |

| ||

Christopher G. Kennedy | Mr. Kennedy was elected as a director in May 2000. He is the Chairman of Joseph P. Kennedy Enterprises, Inc. | |

K. David Kohler | Mr. Kohler was elected as a director in October 2006. Since April |

James B. Miller, Jr. | Mr. Miller was elected as a director in May 2000. Since 1979, Mr. Miller has served as Chairman and Chief Executive Officer of Fidelity Southern Corporation, the holding company for Fidelity Bank. He also has served in various capacities at Fidelity Southern Corporation’s affiliated companies, including as Chief Executive Officer of Fidelity Bank from 1977 to 1997 and from 2003 to the present, Chairman of Fidelity Bank from 1998 to the present, | |

| Ms. Palmer was elected as a director in |

Vote Required and Recommendation of Board

Under the Company’s Bylaws, election of each of the nominees requires a plurality of the votes cast by the Company’s outstanding Common Stock entitled to vote and represented (in person or by proxy) at the meeting. THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE, AND PROXIES EXECUTED AND RETURNED OR VOTED BY TELEPHONE OR INTERNET WILL BE VOTED FOR EACH OF THE NOMINEES UNLESS CONTRARY INSTRUCTIONS ARE INDICATED.

MEETINGSMEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors held fourfive meetings during 2012.2015. All of the incumbent directors attended at least 75% of the total number of meetings of the Board and any committees of which he or she was a member.

Board Leadership Structure and Role in Risk Management

We currently have a Lead Independent Director and a combined Chairman and Chief Executive Officer. Mr. Gable serves as Lead Independent Director, and Mr. Hendrix serves as Chairman and Chief Executive Officer. Although we do not have a formal policy on whether the same person should (or should not) serve as both the Chairman and Chief Executive Officer, the Board has determined that it is appropriate at the current time to have those positions combined in light of the recent death of our founder and original Chairman Ray C. Anderson and the need for continuity of Company leadership following his death.combined. In making this determination,

the Board tookhas taken into account its evaluation of Mr. Hendrix’s performance as Chief Executive Officer, his very positive relationships with the other members of the Board and the Corporation’s various stakeholders, and the strategic vision and perspective he would bringbrings to the Chairman position. In addition, we believe that Mr. Anderson’s high global profile with respect to the Company’s sustainability mission hadhas created similarly high expectations for the role of Chairman of the Company, for which Mr. Hendrix wasis uniquely qualified. The Board wasis of the view that Mr. Hendrix would provideprovides excellent leadership to the Board in the performance of its duties.

Because our Chairman and Chief Executive Officer is an employee of the Company and therefore not considered “independent” under applicable standards (see “Director Independence” below), the Board has appointed Mr. Gable to serve as Lead Independent Director. The Board considers it to be useful and appropriate at the current time to have a non-management director serve in a lead capacity to promote corporate governance, coordinate the activities of the other non-management directors, and perform such other duties and responsibilities as the Board may determine. The specific responsibilities of the Lead Independent Director are as follows:

● | Preside at Executive Sessions. Presides at all meetings of the Board at which the Chairman and Chief Executive Officer is not present, including executive sessions of the independent directors. |

● | Call Meetings of Independent Directors. Has the authority to call meetings of the independent directors. |

● | Function as Liaison with the Chairman. Serves as the principal liaison on Board-wide issues between the independent directors and the Chairman. |

● | Participate in Flow of Information to the Board such as Board Meeting Agendas and Schedules. Provides the Chairman and Chief Executive Officer with input as to meeting agenda items, advises the Chairman and Chief Executive Officer as to the quality, quantity and timeliness of information sent to the Board, and approves meeting schedules to assure there is sufficient time for discussion of all agenda items. |

● | Recommends Outside Advisors and Consultants. Recommends the retention of outside advisors and consultants who report directly to the Board. |

● | Shareholder Communication. Ensures that he is available, if requested by shareholders and when appropriate, for consultation and direct communication. |

The Board of Directors has the following standing committees that assist the Board in carrying out its duties: the Executive Committee, the Audit Committee, the Compensation Committee, and the Nominating & Governance Committee. The following table lists the current members of each committee:

Executive Committee | Audit Committee | Compensation Committee | Nominating & Governance Committee | |||

|

|

|

| |||

Daniel T. Hendrix (Chair) | Carl I. Gable (Chair) | Edward C. Callaway (Chair) | Christopher G. Kennedy (Chair) | |||

Carl I. Gable | James B. Miller, Jr. | Andrew B. Cogan | K. David Kohler | |||

James B. Miller, Jr. | Harold M. Paisner | Sheryl D. Palmer | John P. Burke |

ExecutiveExecutive Committee.The Executive Committee did not meet but acted by unanimous written consent twiceonce during 2012.2015. With certain limited exceptions, the Executive Committee may exercise all the power and authority of the Board of Directors in the management of the business and affairs of the Company.

Audit CommitteeCommittee.. The Audit Committee met four times and acted by unanimous written consent once during 2012.2015. The function of the Audit Committee is to (i) serve as an independent and objective party to review the Company’s financial statements, financial reporting process and internal control system, (ii) review and evaluate the performance of the Company’s independent auditors and internal financial management, and (iii) provide an open avenue of communication among the Company’s independent auditors, management (including internal financial management) and the Board. The Board of Directors has determined that all three members of the Audit Committee are “independent” in accordance with applicable law, including the rules and regulations of the Securities and Exchange Commission and the rules of the Nasdaq Stock Market, and that Mr.each of Messrs. Gable Chair of the Audit Committee,and Miller is an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission. The Audit Committee operates pursuant to an Audit Committee Charter which was adopted by the Board of Directors. The Audit Committee Charter may be viewed on the Company’s website,www.interfaceglobal.com/Investor-Relations/Corporate-Governance/Audit-Committee-Charter.aspx.

CompensationCompensation Committee.The Compensation Committee met fivetwo times and acted by unanimous written consent fourfive times during 2012.2015. The function of the Compensation Committee is to (i) evaluate the performance of the Company’s Chief Executive Officer and other senior executives, (ii) determine compensation arrangements for such executives, (iii) administer the Company’s stock and other incentive plans for key employees, and (iv) review the administration of the Company’s employee benefit plans. The Board of Directors has determined that each member of the Compensation Committee is “independent” in accordance with applicable law, including the rules and regulations of the Securities and Exchange Commission and the rules of the Nasdaq Stock Market. The Compensation Committee operates pursuant to a Compensation Committee Charter that was adopted by the Board of Directors. The Compensation Committee Charter may be viewed on the Company’s website,www.interfaceglobal.com/Investor-Relations/Corporate-Governance/Compensation-Committee-Charter.aspxCompensation-Committee-Charter.aspx. The Compensation Committee’s policies and philosophy are described in more detail below in this Proxy Statement under the heading “Compensation Discussion and Analysis.”

NominatingNominating & GovernanceCommittee. The Nominating & Governance Committee met twice in 2012.2015. The Nominating & Governance Committee assists the Board in reviewing and analyzing, and makes recommendations regarding, corporate governance matters, and it also recommends committee assignments for Board members. The Nominating & Governance Committee also assists the Board in establishing qualifications for Board membership and in identifying, evaluating and selecting qualified candidates to be nominated for election to the Board. The Nominating & Governance Committee also assists the Board in reviewing and analyzing, and makes recommendations regarding, corporate governance matters, and it also recommends committee assignments for Board members.

In the event of a vacancy on the Board, the Nominating & Governance Committee develops a pool of potential director candidates for consideration. The Nominating & Governance Committee seeks candidates for election and appointment with excellent decision-making ability, valuable and varied business experience and knowledge, and impeccable personal integrity and reputations. The Committee does not have a specific diversity policy, but considers diversity of race, ethnicity, gender, age, cultural background and professional experience in evaluating candidates for Board membership, in an effort to obtain a variety of viewpoints in the Board’s proceedings. The Nominating & Governance Committee considers whether candidates are free of constraints or conflicts which might interfere with the exercise of independent judgment regarding the types of matters likely to come before the Board, and have the time required for preparation, participation and attendance at Board and committee meetings. Other factors considered by the Nominating & Governance Committee in identifying and selecting candidates include the needs of the Company and the range of talent and experience already represented on the Board. The Nominating & Governance Committee solicits suggestions from other members of the Board regarding persons to be considered as possible nominees. Shareholdersnominees.Shareholders who wish the Nominating & Governance Committee to consider their recommendations for director candidates should submit their recommendations in writing to the Nominating & Governance Committee, in care of the office of the Chairman of the Board, Interface, Inc., 2859 Paces Ferry Road, Suite 2000, Atlanta, GA 30339. Recommendations should include the information which would be required for a “Shareholder Proposal” as set forth in Article II, Section 9 of the Company’s Bylaws. Director candidates who are recommended by shareholders in accordance with these procedures will be evaluated by the Nominating & Governance Committee in the same manner as director candidates recommended by the Company’s directors.

The Board of Directors has determined that each member of the Nominating & Governance Committee is “independent” in accordance with applicable law, including the rules and regulations of the Securities and Exchange Commission and the rules of the Nasdaq Stock Market. The Nominating & Governance Committee operates pursuant to a Nominating & Governance Committee Charter that was adopted by the Board of Directors. The Nominating & Governance Committee Charter may be viewed on the Company’s website,www.interfaceglobal.com/Investor-Relations/Corporate-Governance/Nominating — Governance-Charter-Nominating---Governance-Charter-(1).aspx(1).aspx..

Risk Management

The Board receives quarterly reports on elements of risk that may potentially affect the Company, as identified and presented by management. The Board also assists in the Company’s risk oversight through its various committees described above below.above. For example, the Audit Committee assists in overseeing risk as it relates to the Company’s financial statements, financial reporting process and internal control system. In that regard, the Company’s Director of Internal Audit and outside auditors report directly to the Audit Committee. The Nominating & Governance Committee assists in overseeing risk related to the Company’s corporate governance practices as well as the performance of individual Board members and committees, while the Compensation Committee assists in overseeing risk as it relates to the Company’s executive compensation program and practices.

PRINCIPALPRINCIPAL SHAREHOLDERS AND MANAGEMENT STOCK OWNERSHIP

The following table sets forth, as of March 8, 20131, 2016 (unless otherwise indicated), beneficial ownership of the Company’s Common Stock by: (i) each person, including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, known by the Company to be the beneficial owner of more than 5% of any class of the Company’s voting securities, (ii) each director and nominee for director, (iii) the Company’s Principal Executive Officer, Principal Financial Officer, and next three most highly compensated executive officers (the “Named Executive Officers”), and (iv) all executive officers and directors of the Company as a group. Due to the nature of the awards, performance shares awarded to the Company’s executive officers in January 2016 are not included in beneficial ownership of Common Stock.

Beneficial Owner (and Business Address of 5% Owners) | Title ofClass | Amount and Nature of BeneficialOwnership | Percent of Class(1) | ||||||||||||

Beneficial Owner (and Business Address of 5% Owners) | Title of Class | Amount and Nature of Beneficial Ownership | Percent of Class(1) | ||||||||||||

Ariel Investments, LLC 200 E. Randolph Drive, Suite 2900 Chicago, Illinois 60601 | Common Stock | 4,678,845 | (2)(3) | 7.1 | % | ||||||||||

BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | Common Stock | 4,423,450 | (2)(4) | 6.7 | % | ||||||||||

Columbia Wanger Asset Management, Inc. 227 West Monroe Street Chicago, Illinois 60606 | Common Stock | 3,643,000 | (2)(5) | 5.5 | % | ||||||||||

FMR LLC and Edward C. Johnson 3d. 83 Devonshire Street Boston, Massachusetts 02109 | Common Stock | 8,799,387 | (2)(6) | 13.3 | % | ||||||||||

Invesco Ltd. 1555 Peachtree Street, NE Atlanta, Georgia 30309 | Common Stock | 4,083,583 | (2)(7) | 6.2 | % | ||||||||||

Bank of New York Mellon Corporation 225 Liberty Street New York, New York 10286 | Common Stock | 5,568,394(2)(3) | 8.5% | ||||||||||||

BlackRock, Inc. 55 East 52nd Street New York, New York 10022 | Common Stock | 7,717,002(2)(4) | 11.8% | ||||||||||||

FMR LLC and Abigail P. Johnson. 245 Summer Street Boston, Massachusetts 02210 | Common Stock | 2,746,753(2)(5) | 4.2% | ||||||||||||

The Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | Common Stock | 3,602,174 | (2)(8) | 5.4 | % | Common Stock | 5,831,529(2)(6)

| 8.9%

| |||||||

John P. Burke | Common Stock | 13,786(7) | * | ||||||||||||

Edward C. Callaway | Common Stock | 12,000 | (9) | * | Common Stock | 10,136(8) | * | ||||||||

Andrew B. Cogan | Common Stock | 4,000 | (10) | * | Common Stock | 15,786(9) | * | ||||||||

Dianne Dillon-Ridgley | Common Stock | 37,203 | (11) | * | |||||||||||

Carl I. Gable | Common Stock | 98,248 | (12) | * | Common Stock | 83,312(10) | * | ||||||||

Jay D. Gould | Common Stock | 93,961(11) | * | ||||||||||||

Daniel T. Hendrix | Common Stock | 729,263 | (13) | 1.1 | % | Common Stock | 360,551(12) | * | |||||||

June M. Henton | Common Stock | 46,600 | (14) | * | |||||||||||

Christopher G. Kennedy | Common Stock | 87,223 | (15) | * | Common Stock | 104,099(13) | * | ||||||||

K. David Kohler | Common Stock | 28,000 | (16) | * | Common Stock | 39,786(14) | * | ||||||||

Patrick C. Lynch | Common Stock | 240,209 | (17) | * | Common Stock | 181,825(15) | * | ||||||||

James B. Miller, Jr. | Common Stock | 42,000 | (18) | * | Common Stock | 53,786(16) | * | ||||||||

Harold M. Paisner | Common Stock | 40,000 | (19) | * | Common Stock | 51,786(17) | * | ||||||||

Lindsey K. Parnell | Common Stock | 196,270 | (20) | * | |||||||||||

Sheryl D. Palmer | Common Stock | 4,736(18) | * | ||||||||||||

John R. Wells | Common Stock | 305,684 | (21) | * | Common Stock | 146,137(19) | * | ||||||||

Raymond S. Willoch | Common Stock | 132,005 | (22) | * | Common Stock | 80,395(20) | * | ||||||||

All executive officers and directors (15 persons) | Common Stock | 2,228,243 | (23) | 3.4 | % | ||||||||||

All executive officers and directors (21 persons) | Common Stock | 1,542,291(21) | 2.4% | ||||||||||||

__________

* Less than 1%.

(1) |

| Percent of class is based on 65,459,106 shares outstanding on March 1, 2016 and is calculated assuming that the beneficial owner or group of beneficial owners has exercised any conversion rights, options or other rights to subscribe held by such beneficial owner that are exercisable within 60 days of March 1, 2016, and that no other conversion rights, options or rights to subscribe have been exercised by anyone else. |

(2) | Based upon information included in statements as of December 31, |

(3) | Bank of |

(4) | According to BlackRock, various persons have the right to receive or the power to direct the receipt of dividends from or the proceeds from the sale of such shares, and no one person’s interests in such shares exceeds 5% of the total outstanding shares of Common Stock. |

(5) | FMR LLC is a parent holding company. |

(6) | The Vanguard Group, Inc. is an investment advisor, and states that it has sole voting power with respect to |

(7) | Includes |

(8) | Includes | |

(9) | Includes 6,611 restricted |

(10) | Includes |

(11) | Includes | |

(12) | Includes 93,039 restricted shares, 4,597 shares held indirectly through the Company’s 401(k) plan, and 50,072 shares held indirectly by family trusts. |

(13) | Includes |

(14) | Includes |

(15) | Includes | |

(16) | Includes 6,611 restricted shares, and 5,000 shares that may be acquired by Mr. Miller pursuant to exercisable stock options. |

(17) | Includes |

(18) | All are restricted shares. |

(19) | Includes |

(20) | Includes |

(21) | Includes 393,162 restricted shares, and 15,000 shares that may be acquired by all executive officers and directors as a group pursuant to exercisable stock options. |

COMPENSATIONCOMPENSATION DISCUSSION AND ANALYSIS

Overall Philosophy and Objectives

The Company’s compensation program is designed in a manner intended to both attract and retain a highly-qualified, motivated and engaged management team whose focus is on enhancing shareholder value. The Company believes a straightforward program that is readily understood and endorsed by its participants best serves these goals, and has constructed a program that contains (1) multiple financial elements, (2) clear and definitive targets, (3) challenging but attainable objectives, and (4) specified performance metrics. More specifically, the objectives of the Company’s management compensation program include:

Establishing strong links between the Company’s performance and total compensation earned — i.e., “paying for performance”;

● | Establishing strong links between the Company’s performance and total compensation earned – i.e., “paying for performance”; | |

● | Providing incentives for executives to achieve specific performance objectives; | |

● | Promoting and facilitating management stock ownership, and thereby motivating management to think and act as owners; | |

● | Emphasizing the Company’s mid and long-term performance, thus enhancing shareholder value; and | |

● | Offering market competitive total compensation opportunities to attract and retain talented executives. |

Providing incentives for executives to achieve specific performance objectives;

Promoting and facilitating management stock ownership, and thereby motivating management to think and act as owners;

Emphasizing the Company’s mid and long-term performance, thus enhancing shareholder value; and

Offering market competitive total compensation opportunities to attract and retain talented executives.

Program Design and Administration

The Compensation Committee of the Board of Directors, which is composed entirely of independent directors, has developed and administers the Company’s executive pay program so as to provide compensation commensurate with the level of financial performance achieved, the responsibilities undertaken by the executives, and the compensation packages offered by comparable companies. The program currently consists of four principal components, each of which is designed to drive a specific behavioral focus, which in turn helps to provide specific benefits to the Company:

Program Component | Behavioral Focus | Ultimate Benefit to Company | ||

Competitive base salary | Rewards individual competencies, performance and level of experience | Assists with attraction and | ||

Annual cash bonuses based on achievement of established goals | Rewards operational results of specific business units and Company as a whole | Aligns individual interests with | ||

Long-term incentives | Rewards engagement, longevity, sustained performance and actions designed to enhance overall shareholder value | Aligns individual interests with | ||

Other elements such as special incentives, retirement benefits and elective deferred compensation | Rewards targeted operational results, engagement and longevity, and sustained performance | Focuses enhanced efforts on a | ||

The Company strives to structure various elements of these program components so that a large portion of executive compensation is directly linked to advancing the Company’s financial performance and the interests of shareholders.

The Committee establishes base salaries for the executive officers, including the Named Executive Officers listed in the “Summary Compensation Table” included in this Proxy Statement. The Committee also administers the annual bonus program, the long-term incentive program, retirement benefits, deferred compensation arrangements, and, when applicable, special incentive programs.

The Committee has directly engaged Pearl Meyer & Partners, a nationally-recognized,nationally recognized, independent compensation consultant, to provide input on compensation matters. The services performed by Pearl Meyer & Partners may vary according to the particular needs of the engagement, but typically will consist of providing a market or peer group overview of compensation elements, including salary, bonus, long-term incentives and special incentives. In prior years,For 2015, the corporate peer group has included: Actuant Corp.; Acuity Brands, Inc.; Albany International Corp.; Apogee Enterprises, Inc.; Armstrong World Industries, Inc.; BE Aerospace, Inc.; The Dixie Group, Inc.; Herman Miller, Inc.; HNI Corporation; Kimball International, Inc.; Knoll, Inc.; Mohawk Industries, Inc.; Steelcase, Inc.; Unifi, Inc.; and USG Corp. In reviewing the Company’s compensation programs for fiscal year 2013, the Committee added to the peer group Apogee Enterprises, Inc. and Armstrong World Industries, Inc., and removed Actuant Corp. Pearl Meyer & Partners also periodically conducts a business performance review of our Company compared with other companies, to assist the Committee in making its compensation decisions. The work of Pearl Meyer to date has not raised any conflict of interest.

The Committee also seeks compensation input from the Company’s Chief Executive Officer, Chief Human Resources Officer, and General Counsel. In addition, the Committee takes into account publicly available data relating to the compensation practices and policies of other companies within and outside the Company’s industry. Furthermore, the policies and programs described below are subject to change as the Committee deems necessary from time to time to respond to economic conditions, meet competitive standards and serve the objectives of the Company and its shareholders.

The Board, in conjunction with management, has reviewed our compensation policies and practices as generally applicable to our employees and determined that they do not encourage excessive risk or unnecessary risk taking and do not otherwise create risks that are reasonably likely to have a material adverse effect on the Company.

Discussion of Principal Elements of Compensation Program

Base Salaries

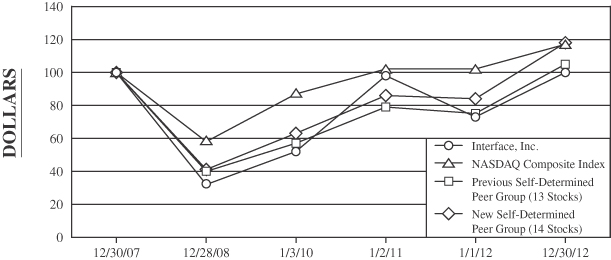

The Committee generally strives to set base salaries at the market median (50th percentile) of salaries offered by other employers in our industry and other publicly traded companies with characteristics similar to the Company (size, growth rate, etc.), based, by and large, on information provided by our independent compensation consultant while also considering internal equalization policies of the Company. Some of the companies considered from time to time are included in the list of companies comprising the “self-determined peer group” index used by our independent compensation consultant and used to create the stock performance graph included in the Company’s Annual Report on Form 10-K for the year ended December 30, 2012.January 3, 2016. That graph is reproduced below for your reference, depicting both the peer group used in prior years as well as the peer group used in reviewing executive compensation for fiscal year 2013.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2012reference.

|

| 12/30/07 | 12/28/08 | 1/3/10 | 1/2/11 | 1/1/12 | 12/30/12 | 1/2/11 | 1/1/12 | 12/30/12 | 12/29/13 | 12/28/14 | 1/3/16 | |||||||

Interface, Inc. | $100 | $32 | $52 | $98 | $73 | $100 | $100 | $74 | $102 | $140 | $109 | $126 | ||||||

NASDAQ Composite Index | $100 | $58 | $87 | $102 | $102 | $117 | $100 | $99 | $114 | $162 | $190 | $200 | ||||||

Previous Self-Determined Peer Group (13 Stocks) | $100 | $40 | $57 | $79 | $75 | $105 | ||||||||||||

New Self-Determined Peer Group (14 Stocks) | $100 | $41 | $63 | $86 | $84 | $118 | ||||||||||||

Self-Determined Peer Group (14 Stocks) | $100 | $97 | $137 | $205 | $227 | $244 | ||||||||||||

Notes to Performance Graph

(1) | The lines represent annual index levels derived from compound daily returns that include all dividends. |

(2) | The indices are re-weighted daily, using the market capitalization on the previous trading day. |

(3) | If the annual interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. |

(4) | The index level was set to $100 as of |

(5) | The Company’s fiscal year ends on the Sunday nearest December 31. |

(6) | The following companies are included in the |

In addition, the Committee may consider other factors when setting individual salary levels, which may result in salaries somewhat above or below the targeted amount. These factors include the executive’s level of responsibility, achievement of goals and objectives, tenure with the Company, and specific background or experience, as well as external factors such as the availability of talent, the recruiting requirements of the particular situation, and general economic conditions and rates of inflation. In this Proxy Statement, compensation for Named Executive Officers based outside the United States is reported in U.S. dollars based on the currency exchange rate in effect as of the end of each fiscal year, and therefore fluctuations in currency exchange rates may impact the reported amounts.

Base salary adjustments for executive officers generally are made (if at all) annually and are dependent on the factors described above. In 2012,2015, each of the Named Executive Officers (other than Mr. Gould, who joined the Company in January 2015) received a base salary increases ranging from 3-7% (anincrease of 3%, representing an aggregate increase of approximately $110,323, or 4.1%,$72,550 for the fivethose four Named Executive Officers) following a period of 19 months during which they had received no base salary increases.Officers.

Please see the “Summary Compensation Table” included in this Proxy Statement for the base salaries ofpaid to the Named Executive Officers in 2012.2015.

AnnualBonuses

The Committee administers the shareholder-approved Executive Bonus Plan, which provides quarterly and annual bonus opportunities for Company executives. The bonus opportunities provide an incentive for executives to earn compensation based on the achievement of important corporate or business unit (division or subsidiary) financial performance. In determining the appropriate bonus opportunities, the Committee seeks to establish potential awards that, when combined with annual salary, place the total overall cash compensation opportunity for the Company’s executives in the third quartile (betweenat the market 5075th percentile and the market 75th percentile) for comparable companies, provided that the performance objectives are substantially achieved.

Each

2015 Annual Bonus Structure

For 2015, each executive officer of the Company, including the Chief Executive Officer, iswas assigned a bonus potential, (typically ranging between 90% and 110% of base salary), and a personalized set of quarterly and annual financial objectives. The Chief Executive Officer’s bonus potential was 130% of base salary, the Chief Operating Officer’s bonus potential was 100% of base salary, and the bonus potential for the other Named Executive Officers was 90% of base salary. Actual awards cancould range from 0% to 150% of the bonus potential, depending on the degree to which the established financial objectives arewere achieved, and arewere paid on a quarterly and annual basis in the following manner:

Achievement of Objectives | Percentage of Bonus Opportunity Payable | Timing of Payment to Employee Participant | ||||

First Quarter Objectives Achieved | 15% | Approximately 45 days following end of first quarter | ||||

Second Quarter Objectives Achieved | 15% | Approximately 45 days following end of second quarter | ||||

Third Quarter Objectives Achieved | 15% | Approximately 45 days following end of third quarter | ||||

Fourth Quarter Objectives Achieved | 15% | Approximately 60 days following end of year | ||||

Fiscal Year Objectives Achieved | 40% | Approximately 60 days following end of year |

In 2012,2015, 100% of the bonus potential for the Chief Executive Officer, Chief Financial Officer and each of the other Named Executive Officers was based on measurable financial objectives. For Messrs. Hendrix, Lynch, Gould and Wells (who manages the Company’s Americas floorcoverings business),Willoch, these objectives consisted of growth in operating income and cash flow, for operations managed, FLOR (consumer products division) gross billings, and earnings per share, and the relative weights assigned to these financial objectives were 60%, 10%, 10%75% and 20%, respectively. For Messrs. Lynch and Willoch, these objectives consisted of growth in operating income, cash flow and earnings per share, and the relative weights assigned to these financial objectives were 60%, 20% and 20%25%, respectively. For Mr. ParnellWells (who manages the Company’s European operations)Americas division), the objectives and relative weights assigned were growth indivisional operating income and(40%), consolidated operating income (25%), divisional cash flow for operations managed(15%), and earnings per share, and the relative weights were 60%, 20% and 20%, respectively.

For each objective, the Committee establishes a threshold level that must be achieved in order for any bonus amount to be earned with respect to that objective, and establishes a goal that must be achieved or exceeded to maximize bonus compensation for that objective (except that no bonus is payable if the threshold for operating income is not exceeded). A pro rata bonus amount is earned to the extent that the threshold is exceeded, up to 150% of the goal number for the Chief Executive Officer and for the other Named Executive Officers. Historically, the Committee has set the threshold level, in its discretion, based primarily on a consideration of the Company’s prior year results for each objective, such that no bonus will be earned with respect to the objective in the event that the Company fails to experience improvement. Also historically, the Committee has set the goal, in its discretion, based primarily on factors that would approximate 15% sales growth and 20% operating income and earnings per share growth from such incremental sales. With respect to cash flow, the Committee sets the goal, in its discretion, using similar approximations, but taking into account anticipated growth initiatives, capital expenditures, research and development costs, debt maturities, and other cash uses that the Committee deems relevant. Given this methodology, the Committee believes that the threshold level, while challenging, is reasonably likely to be achieved in normalized market conditions, while the target would be fully achieved or exceeded only with exceptional performance.

For example, the 20122015 annual thresholds and goals that were applicable for our Chief Executive Officer, excluding accruals for bonuses, were as follows:

Criteria | Threshold | Goal | Threshold | Goal | ||||||

Operating Income | $ | 76,000,000 | $ | 111,650,000 | $80,000,000 | $115,000,000 | ||||

Cash Flow | $ | 15,750,000 | $ | 24,250,000 | $30,000,000 | $40,000,000 | ||||

FLOR Gross Billings | $ | 31,000,000 | $ | 39,000,000 | ||||||

Earnings Per Share | $ | 0.49 | $ | 0.68 | ||||||

For 2012,2015, each of the Named Executive Officers received a bonus, which appears in the “Summary Compensation Table” included in this Proxy Statement, as their respective performance objectives were determined to have been achieved, in part, during the year. The bonuses were attributable to their achieving or exceeding their respective financial objective goals, primarily during the first, second throughand fourth quarters of the year.

2016 Annual Bonus Structure

For fiscal year 2013, annual incentive awards are again based on2016, the achievement of important corporate or business unit (division or subsidiary) financial performance. The annual incentive awards for 2013 are structured in a mannerbonus structure is similar to the annual incentive awards in 2012,that for 2015, but with the performancemodifications described in this section. The bonus potential for each Named Executive Officer remains the same, except that the Chief Operating Officer’s bonus potential has been increased to 115% of base salary. The financial objectives and relative weightsweighting remain the same, except that, for Mr. Hendrix being operating income (65%), cash flow (25%) and FLOR gross billings (10%), and for Messrs. Lynch and Willoch being operating income (75%) and cash flow (25%). For Mr. Wells, the performance objectives and relative weights are divisional operating income (35%), consolidated operating income (20%), divisional cash flow (15%), FLOR gross billings (10%) andcriterion of divisional operating income contribution margin (20%). has been changed to divisional gross profit. The Committee also has eliminated the quarterly opportunity for executive officers, so the entire bonus opportunity is now based on full fiscal year performance.

For Mr. Parnell,each financial objective, the performance objectivesCommittee has established a threshold amount, a goal amount, and relative weights are divisionala maximum amount. The threshold amount must be achieved in order for any bonus amount to be earned with respect to that objective (except that no bonus is payable if the threshold amount for operating income (40%)is not exceeded). A pro rata bonus amount is earned based upon (i) the degree to which the threshold amount (resulting in a “cut in” payout equal to 25% of the bonus potential for that criterion) is exceeded, up to the goal amount (resulting in a payout equal to 100% of the bonus potential for that criterion), consolidated operating income (25%), divisional cash flow (15%), Germany gross billings (10%) and divisional gross billingsor (ii) the degree to which the goal amount (resulting in a payout equal to 100% of the hospitality market segment (10%)bonus potential for that criterion) is exceeded, up to the maximum amount (resulting in a payout equal to 150% of the bonus potential for that criterion).

Long-TermLong-Term Incentives

The Committee administers the shareholder-approved Interface, Inc. Omnibus Stock Incentive Plan (the “Omnibus Stock Plan”), which is an equity-based plan that allows for long-term incentive awards such as restricted stock and stock options. The Omnibus Stock Plan provides for the grant to key employees and directors of the Company and its subsidiaries of restricted stock, incentive stock options (which qualify for certain favorable tax treatment), nonqualified stock options, stock appreciation rights, deferred shares, performance shares and performance units. The size of the awards made to individual officers is based on an evaluation of several factors, including the officer’s level of responsibility, the officer’s base salary and the Company’s overall compensation objectives. The amount and nature of prior equity incentive awards also are generally considered in determining new Omnibus Stock Plan awards for executive officers.

Long-term incentives are intended to attract and retain outstanding executive talent, create a direct link between shareholder and executive interests by focusing executive attention on increasing shareholder value, and

motivate executives to achieve specific performance objectives. For instance, stock options (when granted) have an exercise price equal to at least 100% of the market price of the underlying Common Stock on the date of grant. Thus, the stock options only have value if the market price of the Company’s stock rises after the grant date. Additionally, restricted stock awards generally vest, in whole or in part, over a period of multiple years (three to five years for grants made in recent years), giving the executive an incentive to remain employed with the Company for a significant time period to have the opportunity to vest in an award. Moreover, awards of restricted stock may vest earlier if specific performance criteria are met, and these performance criteria are designed to drive shareholder value.value are met. (As discussed below, 50%50-60% of the restricted stock awards granted during 2010-20122013-2015 are ineligible for time/retention vesting and are forfeited altogether if the performance criterion is not met).met.) All equity awards (whether restricted stock, performance shares or otherwise) will have a minimum vesting period or minimum performance period of at least one year.

Description ofAvailableAwards

Restricted Shares

Awards of restricted shares under the Omnibus Stock Plan generally vest over a period of multiple years following the date of award, and may vest earlier if specified performance criteria established by the Committee are satisfied. Unvested awards are also subject to forfeiture under certain circumstances. All restricted shares awarded to date have been made without consideration from the participant (although the Omnibus Stock Plan authorizes the Committee, in connection with any award, to require payment by the participant of consideration, which can be less than the fair market value of the award on the date of grant). Awards of restricted stock generally will not be transferable by the participant other than by will or applicable laws of descent and distribution.

Stock Options

Options granted under the Omnibus Stock Plan may be incentive stock options (as defined in Section 422 of the Internal Revenue Code of 1986, as amended), nonqualified stock options or a combination of the foregoing, although only employees are eligible to receive incentive stock options. All options under the Omnibus Stock Plan will be granted at an exercise price per share equal to not less than 100% of the fair market value of the Common Stock on the date the option is granted. Options may be structured to vest over a period of multiple years. Options granted under the Omnibus Stock Plan expire following a pre-determined period of time after the date of grant (which may not be more than 10 years after the grant date), and generally will terminate on the date three months following the date that a participant’s employment with the Company terminates.

The Company receives no consideration upon the granting of an option. Full payment of the option exercise price must be made when an option is exercised. The exercise price may be paid in cash or in such other form as the Committee may approve, including shares of Common Stock valued at their fair market value on the date of option exercise. Options generally will not be transferable by the holder thereof other than by will or applicable laws of descent and distribution.

The Committee has not granted stock options to any executive officer in the past three years.

Other Potential Awards

The Omnibus Stock Plan also provides for the award of stock appreciation rights, deferred shares, performance shares and performance units. To date,Through the end of 2015, the Committee hashad not granted any of these types of awards. In 2016, the Committee granted awards of performance shares, as described below.

RecentOmnibus Stock Plan AwardsAwards to Named Executive Officers

In July 2010, each of the Named Executive Officers received an award of restricted stock. The 2010 awards are eligible to performance vest to the extent that the Company’s earnings per share plus dividends reaches specified target levels during a three-year performance period, with a special accelerated vesting opportunity based on 2010 earnings per share plus dividends. Fifty percent of any unvested shares from the 2010 award will vest on the third anniversary of the grant date if the executive remains employed by the Company at that time. Substantially all of these shares vested based on the Company’s 2010 performance, and the small remainder vested based on the Company’s 2011 performance.

In January 2011, each of the Named Executive Officers received an award of restricted stock. The 2011 awards are eligible to performance vest to the extent that the Company’s earnings per share plus dividends reaches or exceeds 23% compound annual growth during a three-year performance period. Fifty percent of any unvested shares from the 2011 award will vest on the third anniversary of the grant date if the executive remains employed by the Company at that time. None of the 2011 awards have vested to date.

In February 2011, Mr. Hendrix received a special award of 200,000 shares of restricted stock. This special award iswas eligible to performance vest to the extent that FLOR gross billings reach specified target levels during a five-year performance period that includesincluded fiscal years 2011 through 2015. None of the shares arewere eligible to vest based on Mr. Hendrix’s tenure of employment. The Committee believesbelieved this special award was appropriate because (1) the Committee wanted to focus management on the growth of the FLOR consumer carpet tile business, both through the internet and catalog channels as well as through additional FLOR retail store openings,stores, and (2) the Committee believed that the number of restricted shares held by Mr. Hendrix had fallen well below historical and market levels as well as the levels desired both for his retention and to align his compensation with the long-term interests of our shareholders. In February 2013, 40,000 of these shares vested based on FLOR’s gross billings achievement in 2012. None of the remaining 160,000 shares vested, and thus those shares were forfeited in February 2016.

In March 2012,January 2013, each of the Named Executive Officers received an award of restricted stock. The 2013 awards were eligible to performance vest to the extent that the Company’s earnings per share plus dividends reached or exceeded specified levels during a three-year performance period of 2013 to 2015 (the goal was approximately 15% compound annual growth for 2013 and 10% compound annual growth thereafter). Half of the award became eligible to vest based on results in the first year of the performance period, and all of the award was eligible to vest based on results in the second or third year. Forty percent of any unvested shares (i.e., shares that had not performance vested) from the 2013 award would vest on the third anniversary of the grant date if the executive remained employed by the Company at that time. In February 2014, half of these awards vested based on the Company’s level of earnings per share plus dividends achieved in 2013, and the other half vested in February 2016 based on the Company’s level of earnings per share plus dividends achieved in 2015.

In January 2014, each of the Named Executive Officers received an award of restricted stock structured in the same manner as the January 20112013 awards described above (except that fifty percent of any unvested shares were eligible to time vest on the third anniversary of the grant date if the executive remained employed by the Company at that time), and the awards were eligible to performance vest to the extent that the Company’s earnings per share plus dividends reached or exceeded specified levels during the three-year performance period of 2014 to 2016 (the goal was approximately 15% compound annual growth for 2014 and 10% compound annual growth thereafter). All of the 2014 awards vested in February 2016 based on the Company’s level of earnings per share plus dividends achieved in 2015.

In January 2015, each of the Named Executive Officers received an award of restricted stock structured in the same manner as the January 2014 awards described above, and the awards are eligible to performance vest to the extent that the Company’s earnings per share plus dividends reaches or exceeds specified levels during the three-year performance period of 2015 to 2017 (the goal was approximately 15% compound annual growth for 2015 and is 10% compound annual growth thereafter). In February 2016, half of these awards vested based on the Company’s level of earnings per share plus dividends achieved in 2015.

2016Omnibus Stock PlanAwards to Named Executive Officers

For 2016, the Committee modified the equity award program and divided each executive’s award into three equal subparts.

The first subpart of each award was granted as restricted stock, and the shares will vest 100% on the third anniversary of the grant date, if the executive remains employed with the Company until that date. The executive also has the right to receive any cash dividends paid on the restricted stock, throughout the three-year term.

The second subpart of the award was granted as performance shares, with an opportunity for part of the award to vest based on the Company’s earnings per share (“EPS”) in each of the years 2016 and 2017, and any shares that have not previously vested have the opportunity to vest based on the Company’s EPS in 2018. The amount of performance shares that vest will be determined pro rata based upon (i) the degree to which an applicable EPS threshold level is achieved (at which point 25% of the performance shares would vest) or exceeded up to an applicable EPS target level (at which point 100% of the performance shares would vest), or (ii) the degree to which the applicable EPS target level is exceeded up to an applicable EPS maximum level (at which point two times the nominal performance shares would vest). There is no “time vesting” opportunity for this subpart. “Dividend equivalents” will accrue on these awards of performance shares and be paid only if and when the related performance shares vest.

The third subpart of the award also was granted as performance shares, with an opportunity for the award to vest based on the Company’s cumulative operating income during the three-year performance period. Noneperiod of 2016-2018. The pro rata vesting structure and dividend equivalent provisions are essentially the 2012 awards have vested to date.same as those described for the second subpart above.

Stock Ownership and Retention Guidelines

To further tie the financial interests of Company executives to those of shareholders, the Committee has established stock ownership and retention guidelines. Under thesethe guidelines that were in place through the end of 2015, executive officers arewere expected to accumulate a number of shares (unrestricted) of the Company’s Common Stock having a value equaling one and one-half times base salary in the case of the Chief Executive Officer and one times base salary in the case of the other executive officers (based on salaries and the stock price at the time the guidelines were adopted several years ago). AllThe expectation was for executives have nowto reach this ownership level within four years of being appointed as an executive officer. As of the end of 2015, all executive officers had met this target.target, with the exception of Jay Gould (President and Chief Operating Officer), Matt Miller (Vice President and Chief Strategy Officer) and Katy Owen (Vice President and Chief Human Resources Officer), each of whom was appointed as an executive officer in 2015. To facilitate accomplishing the ownership targets, executive officers generally are expected to retain at least one-half of the net after-tax shares (i.e., the net shares remaining after first selling sufficient shares to cover the anticipated tax liability and, in the case of stock options, the exercise price) obtained upon the vesting of restricted stock and the exercise of stock options.

For 2016, the Committee increased the stock ownership and retention guidelines, so that executives are now expected to accumulate a number of shares (unrestricted) of the Company’s Common Stock having a value equaling three times base salary in the case of the Chief Executive Officer and two times base salary in the case of the other executive officers (based on salaries and the stock price at the time the new guidelines were adopted). The expectation is for executives to reach this ownership level by March 2020.

Directors also are subject to stock ownership requirements. The directors who were serving when the requirements were adopted wereDirectors are required to accumulate at leasthold 2,000 shares (unrestricted) by March 31, 2006, and anyunrestricted shares. Any new director elected thereafter is required to accumulate at least 2,000these shares (unrestricted) by the second anniversary of his or her election. All current directors have met this stock ownership standard, with the exception of Mr. Coganexcept Ms. Palmer, who was elected as a director in January 2013.October 2015. As a guideline, non-employee directors also are expected to retain during their tenure all of the net after-tax shares obtained upon the vesting of restricted stock and at least one-half of the net after-tax shares obtained upon the exercise of stock options.

The Company has a policy that generally prohibits all of its employees, officers and directors from engaging in short sales or trading in puts, calls and other options or derivatives with respect to the securities of the Company.

Other Elements of Compensation Program

In addition to the principal compensation program elements described above, the Company has adopted a number of other elements to further its compensation program goals. They are as follows:

| ● | |||

| ● | Severance Agreements | |

| ● |

| ● | Perquisites |

| ● |

| ● | Special Incentive Programs |

401(k) Plan and Other Defined Contribution Plans

The Company maintains the Interface, Inc. Savings and Investment Plan (the “401(k) Plan”), a tax-qualified 401(k) plan which provides its U.S.-based employees a convenient and tax-advantaged opportunity to save for retirement. The Company’s Named Executive Officers who are based in the United States are eligible to participate in the 401(k) Plan on the same terms as other executive and non-executive employees based in the United States, and receive the same benefits afforded all other participants. Under the 401(k) Plan, all participating employees are eligible to receive matching contributions that are subject to vesting over time. The Company periodically evaluates the level of matching contributions afforded participant employees to ensure competitiveness in the marketplace. The Company matches 50% of the first 6% of the employee’s eligible compensation (capped by statutory limitations) that the employee contributed to the 401(k) Plan.

Mr. Parnell, who is based in Europe, participates in a defined contribution retirement plan. Pursuant to this plan, the Company contributed $38,358 to Mr. Parnell’s account in 2012.

Elective Deferred Compensation Program

The Company also maintains the Interface, Inc. Nonqualified Savings Plan and Interface, Inc. Nonqualified Savings Plan II (collectively, the(the “Nonqualified Plan”) for certain U.S.-based “highly compensated employees” (as such term is defined in applicable IRS regulations), including the Named Executive Officers who are based in the United States. The compensation level required to participate in the Nonqualified Plan is $115,000was $120,000 in total annual compensation, and the Company has 94had 101 participants in the plan (including both current and former employees). at the end of 2015. As with the Company’s 401(k) Plan, the Named Executive Officers who are based in the United States are eligible to participate in the Nonqualified Plan on the same terms as other executive and non-executive eligible employees based in the United States, and receive the same benefits afforded all other participants. Under the Nonqualified Plan, all eligible employees can elect to defer, on a pre-tax basis, a portion of their salary and/or annual bonus compensation. The Company matches 50% of the first 6% of the employee’s eligible salary and bonus that was deferred, less any potential Company matching amounts under the 401(k) Plan.

The Nonqualified Plan also contains a “Key Employee Retirement Savings Benefit” feature to permit discretionary contributions to certain key employees’ accounts (in a separately tracked sub-account) to enhance retirement savings and to couple such contributions with vesting structures that will promote the retention of such key employees. In each of 2010, 2011 and 2012,the years 2013-2015, the Compensation Committee made a Key Employee Retirement Savings Benefit contribution of $50,000 to the Nonqualified Plan account of Mr. Lynch. This contribution will vest 50% upon his reaching age 50 and 50% upon his reaching age 55, assuming continuous service with the Company until such ages.

Please see the “Non-Qualified Deferred Compensation” table included in this Proxy Statement for further details regarding the Nonqualified Plan, as well as the Company’s Named Executive Officers’ contributions, earnings and account balances applicable to the Nonqualified Plan for fiscal year 2012.2015.

Pension/Salary Continuation Programs

Foreign Defined Benefit Plans

The Company has trustee-administered defined benefit retirement plans (“Pension Plans”) which cover certain of its overseas employees. The benefits are generally based on years of service and the employee’s average monthly compensation. As determined by their respective trustees, the investment objectives of the Pension Plans are to maximize the return on the investments without exceeding the limits of prudent pension fund investment and to ensure that the assets ultimately will be sufficient to exceed minimum funding requirements. The goal is to optimize the long-term return on plan assets at a moderate level of risk, by balancing higher-returning assets, such as equity securities, with less volatile assets, such as fixed income securities. The assets are managed by professional investment firms and performance is evaluated periodically against specific benchmarks. The Pension Plans’ net assets did not include any shares of the Company’s own stock at December 30, 2012.January 3, 2016. None of our executive officers participate in the Pension Plans.

Salary Continuation Plan

The Company maintains a nonqualified Salary Continuation Plan designed to induce selected employees of the Company to remain in the employ of the Company by providing them with retirement, disability and death benefits in addition to those whichthat they may receive under the Company’s other benefit programs. The Salary Continuation Plan entitles participants to (i) retirement benefits upon normal retirement from the Company at age 65 (or early retirement as early as age 55) after completing at least 15 years of service with the Company (unless otherwise provided in the plan), payable for the remainder of their lives (or, if elected by a participant, a reduced benefit is payable for the remainder of the participant’s life and any surviving spouse’s life) and in no event for less than 10 years under the death benefit feature; (ii) disability benefits payable for the period of any pre-retirement total disability; and (iii) death benefits payable to the designated beneficiary of the executive for a period of up to 10 years. The annual retirement benefit for retirement at age 65 is 50% of the executive’s final average earnings (defined as the average of the salary and bonus paid by the Company for the four individual calendar years of the executive’s highest compensation during the last eight full calendar years of the executive’s employment with the Company ending on or prior to the effective date of the executive’s retirement), which decreases proportionately to 30% of final average earnings for early retirement at age 55. The annual disability benefit is structured to essentially equate to 66% of current pay (salary and bonus) at the time of disability. The annual death benefit, for the 10-year payment period, is 50% of final average earnings, for a pre-retirement death, or a continuation of the actual retirement payments for the balance of the 10-year period (if any) for a post-retirement death (assuming no election of spousal survival benefits). The Salary Continuation Plan is administered by the Compensation Committee, which has full discretion in choosing participants anddetermined that the benefits applicableSalary Continuation Plan is closed to each.any new participants. The Company’s obligations under the Salary Continuation Plan are currently unfunded (although the Company uses insurance instruments in an irrevocable grantor (“rabbi”) trust to hedge its exposure thereunder); however, the Company is required to contribute the full present value of its obligations thereunder to an irrevocable grantora rabbi trust in the event of a “Change in Control” (as such term is defined in the Salary Continuation Plan) of the Company.

Pursuant to the Salary Continuation Plan, the Company has maintained Salary Continuation Agreements with each of Named Executive Officers Hendrix, Wells and Willoch since 1986, 1998 and 1996, respectively. (The Company most recently amended and restated the Salary Continuation Agreements with Messrs. Hendrix, Wells and Willoch in January 2008, primarily to comply with Section 409A of the Internal Revenue Code of 1986, as amended. The benefits under their amended and restated agreements are substantially similar to those under their respective prior agreements.) The individual Salary Continuation Agreements contain essentially all of the benefit terms and conditions, and those agreements control in the event of any conflict with the Salary Continuation Plan document. Please see the “Pension Benefits” table included in this Proxy Statement for information about the Salary Continuation Plan benefits applicable to Messrs. Hendrix, Wells and Willoch.

Severance Agreements

The Company has substantially similar Employment and Change in Control Agreements in effect with each of Messrs. Hendrix, Lynch, Wells and Willoch, and has two employment agreements in effect with Mr. Parnell covering his activities (i) within and (ii) outside of the United Kingdom.Named Executive Officers. These agreements generally provide for certain benefits (salary, bonus, medical benefits, etc.) in the event of a Named Executive Officer’s termination of employment without “cause” (as defined in the agreements), as well as certain benefits upon his resignation, death or disability. These agreements also contain provisions placing restrictions on a Named Executive Officer’s ability to compete with the Company, or solicit its customers or employees, for a specified period of time following termination of employment. For Messrs. Hendrix, Lynch, Wells and Willoch, theseThese agreements also provide for certain benefits in the event of a termination of employment in connection with a “Change in Control” (as defined in the agreements) of the Company. Mr. Parnell is not a party to a change in control agreement.

Please see the further discussion below in the “Potential Payments Upon Termination or Change of Control” section of this Proxy Statement regarding the respective employment and change in control agreements of the Company’s Named Executive Officers.

Perquisites

In order to provide a market competitive total compensation package to certain of the Company’s executive officers, including the Named Executive Officers, the Company provides those limited perquisites that it believes enable its Named Executive Officers to perform their responsibilities efficiently and with minimal distractions. The perquisites provided to one or more Named Executive Officers in 20122015 included the following:

| ● | |||

| ● | Long-term care and life insurance | |

| |||

| ● |

| ● | Split dollar insurance agreement (for Mr. Hendrix only) |

| ● | Company-provided telephone |

Please see the “Summary Compensation Table” included in this Proxy Statement (and the notes thereto) for a more detailed discussion of these perquisites and their valuation.

Special Incentive Programs

From time to time, in its discretion, the Committee may implement special incentive programs which provide executives an opportunity to earn additional compensation if specific performance objectives are met. Special incentive programs are used when the Committee recognizes a need or desire for the Company to achieve one or more targeted strategic or financial objectives (such as stock price appreciation, debt reduction, cash accumulation, or attainment of a specified financial ratio), in addition to those objectives generally covered by annual bonuses and long-term incentives. The time period for achievement of the objectives may vary from less than a year to a multiple-year period. In each case, the performance objectives are designed to represent challenging but achievable targets that will serve to align the interests of executives with the interests of shareholders, and encourage executives to think and act as owners.

No special incentive programs were applicable during 2010-2012.2013-2015.

Compensation Deductibility

An income tax deduction under federal law will be generally available for annual compensation in excess of $1 million paid to the chief executive officer and the named executive officers of a public corporation only if that compensation is “performance-based” and complies with certain other tax law requirements. Executive compensation under the Company’s Executive Bonus Plan, described above, meets these requirements and therefore qualifies for an income tax deduction under federal law.

Although the Committee considers deductibility issues when approving executive compensation elements, the Company and the Committee believe that other compensation objectives, such as attracting, retaining and providing incentives to qualified managers, are important and may supersede the goal of maintaining deductibility. Consequently, the Company and the Committee may make compensation decisions without regard to deductibility when it is deemed to be in the best interests of the Company and its shareholders to do so.

COMPENSATIONCOMMITTEECOMPENSATION COMMITTEE REPORT